Boost your career with DFA! Learn Tally, GST, payroll, and accounting skills for jobs in finance, business, and accounting firms.

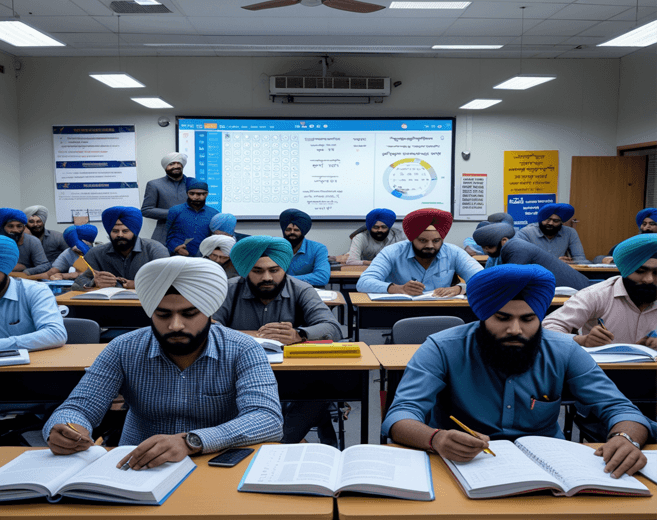

The Diploma in Financial Accounting (DFA) is a job-oriented 6-month professional course designed for students and professionals seeking careers in finance, accounting, or business. This course offers in-depth knowledge of accounting principles, Tally Prime, GST, Income Tax, MS Excel, and more — combining theory with hands-on practice to make you industry-ready.

The Diploma in Financial Accounting (DFA) is a professional short-term course designed to equip students, job seekers, and working professionals with the essential skills required in modern accounting, taxation, and financial reporting. It offers both theoretical understanding and hands-on practical training in Tally Prime, GST filing, income tax basics, payroll management, and business accounting.

In today’s business world, financial management plays a crucial role in the success of every organization. DFA is a career-focused course that prepares individuals to work confidently in the accounting departments of businesses, CA firms, tax consultancies, and government offices. It is especially useful for those who want to become junior accountants, billing executives, Tally operators, or financial assistants.

The course covers the entire accounting cycle, from basic concepts like journal entries and ledger posting to advanced topics like GST return filing, balance sheet preparation, payroll processing, and MIS reporting using Excel. It also includes practical training on Tally Prime — the most widely used accounting software in India — and Excel for accountants, which is essential for real-world reporting and analysis.

One of the main highlights of DFA is its strong focus on GST (Goods and Services Tax), which is now a key part of every Indian business. Students learn how to create GST-compliant invoices, calculate tax liability, manage ITC (Input Tax Credit), and file returns like GSTR-1 and GSTR-3B. This knowledge gives students a strong advantage when applying for jobs in finance, accounting, and taxation roles.

The DFA course is suitable for students who have passed 10+2 in any stream (Arts, Commerce, Science) and wish to build a career in the accounting and finance sector. Even small business owners, freelancers, or self-employed individuals can benefit from this course to manage their own finances and tax compliance.

The duration of the course is typically 6 months to 1 year, depending on the institute and learning mode (offline or online). Upon completion, students receive a Government-recognized certificate (MSME/ISO affiliated), which is valid for both private and government job applications.

In addition to technical skills, students are also trained in office documentation, invoice preparation, tax report generation, and basic communication skills required in an accounting environment.

After completing the DFA course, students can apply for roles such as Account Executive, Billing Assistant, Tally Operator, GST Return Preparer, Payroll Executive, and even pursue freelancing work in online bookkeeping and financial services.

In conclusion, the Diploma in Financial Accounting is a smart investment for anyone looking to build a stable, rewarding, and in-demand career in the field of accounts and finance. With digital accounting becoming a norm, this course offers the exact skills needed to succeed in the job market today.

Certified, Industry-Experienced Trainers

Required for many government and private sector jobs

Practical knowledge, projects, and case studies

Real-life projects and assignments

Recognized certificate after course completion

10th/12th pass students, graduates, job seekers, and small business owners.

Yes, complete hands-on training is given in all modules.

Yes, it prepares you for roles like Accountant, Tally Operator, GST Executive.

Yes, a recognized certificate is given after successful completion.

Yes, you can join offline or online mode as per your convenience.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Websites store cookies to enhance functionality and personalise your experience. You can manage your preferences, but blocking some cookies may impact site performance and services.

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Google Tag Manager simplifies the management of marketing tags on your website without code changes.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com

You can find more information in our Home and Privacy Policy.